Wake Up, Beeple!

Crypto-backed artworks at Art Basel Miami Beach advance the wealth mechanisms they claim to subvert and make you, the viewer, a participant in the ploy.

A monstrous specimen of art as social commentary takes form when the work in question replicates the mechanisms the artist boasts about subverting, and at Art Basel Miami Beach, in a new section titled Zero 10 backed by the crypto marketplace OpenSea, Jack Butcher’s “Self Checkout” (2025) is its most shameless manifestation.

The installation consists of a checkout counter powered by Stripe terminals that beckon visitors to tap their cards and pay any amount, receiving a printed receipt whose length is proportional to their payment and comes with an “NFT companion.” A ticker above the counter tracks the lucre from an initial value of -$75,000, Butcher’s stated investment in the piece. When I informed a man who forked over $37 for a rather short receipt that he could have bought several pastries at the nearby Maman Café with that money, he looked at me like I was the ignorant one, like I was the one who had missed the point. “I have purchased an original artwork,” he told me.

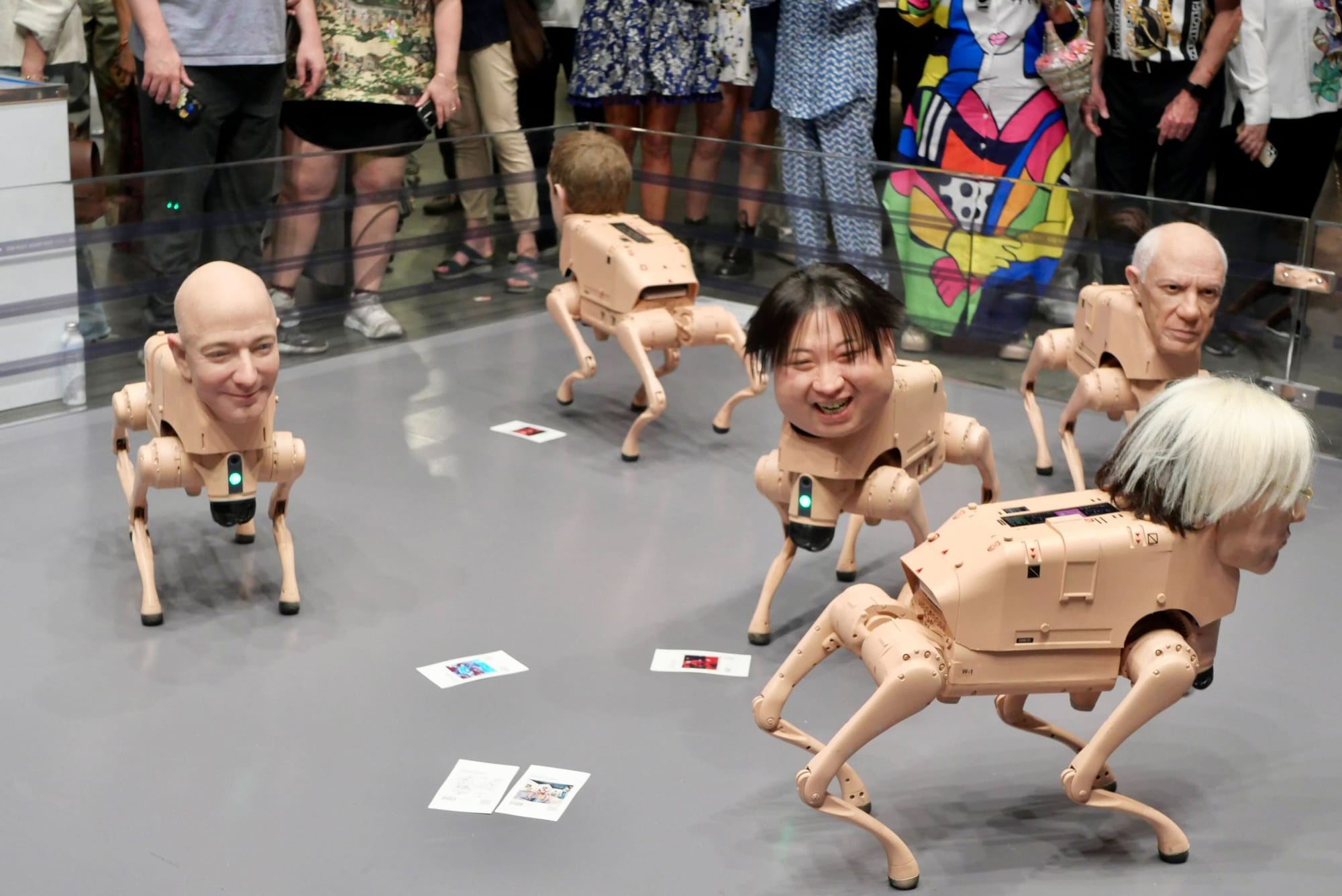

Nearby, Beeple’s humanoid robodogs with the faces of Elon Musk, Jeff Bezos, Andy Warhol, and others (including the artist himself, born Mike Winkelmann) patter around in a playpen, occasionally excreting “certificates of authenticity.” Some of these certificates feature a QR code with — surprise, surprise — a link to a (free) NFT. Cameras inside the robot pups, each worth $100,000 and sold out, are constantly photographing their surroundings, which are altered using AI and printed on the pieces of paper expelled from their rears. The robots are taking photographs of YOU.

A wall text for Beeple’s work describes this AI slop as “memories” that are “reimagined and preserved on the blockchain,” adding to “the ever-expanding global data set that future AI will be trained on.” It says the work “probes the tension between control and autonomy … inviting us to reconsider the boundaries of art, identity, and the nature of our relationship with technology.”

This heaping pile of verbiage is more insidious than your standard art-world jargon because it euphemizes the real purpose of these installations, which is to advance crypto wealth by making you, the viewer, an active participant in the ploy.

And no, not all such artworks are like this, and not every part of the art world or market is complicit. Take Richard Serra’s seven-minute video work “Television Delivers People” (1973), produced with Carlota Fay Schoolman and broadcast on cable TV. Against a bright blue background reminiscent of a low-budget public service announcement, soundtracked by uncanny elevator music, a scrolling text reads: “Television delivers people to an advertiser.” “You are the product of T.V.,” it continues. “You are delivered to the advertiser who is the consumer.” Serra and Schoolman infiltrated the medium in earnest, achieving subversion not on the technology’s terms, but on those of the spectator, whom the piece essentially views as equals.

In marked contrast, installations like Butcher’s and Beeple’s make a mockery of the viewer, as do the art-world adjudicators who approved and erected them, shrouding their intentions in the legacy of Kazimir Malevich’s avant-garde. As Kate Vass, a self-described Web3 advisor whose namesake gallery in Switzerland has specialized in digital art for years, astutely wrote, “That contradiction — between the language of progress and the persistence of power — is what defines our moment.” She added: “Art Basel didn’t lower its entry barriers to embrace a new ideology; it did so to fill the economic gaps left by the galleries that closed or withdrew last year."

The grift of crypto, like the grift of AI, hinges on masses of people believing that an exploitative technology is actually an opportunity. A few days ago, the House Judiciary Committee released a damning report on President Donald Trump’s crypto operations, including his dismantling of anti-corruption protocols and the sale of assets like his own “memecoin” token, which yielded him more than $800 million in the first half of 2025 — not to mention the billions added to his net worth through World Liberty Financial. Trump succeeded in this scheme by luring buyers not just with the prospect of wealth but also with the promise of access, such as invitations to exclusive dinners for top investors in his coin. Now, that empire is crashing, bringing the people who bought in down with it.

The cultural gatekeepers will tell you that you can buy your place in history. They will say that you are part of a conversation, part of an unprecedented moment. Don't listen to them.